Bitcoin Rating Overview: Institutional-Grade Insights for the Crypto Landscape

Unpacking Bitcoin’s strengths, risks, and future potential through data-driven analysis, offering clarity in the evolving world of digital assets.

Asset Name: Bitcoin (BTC)

Overall Rating: AAA

Tech/Adoption Grade: AAA

Market Performance Grade: AA+

Key Takeaways:

Bitcoin sets the benchmark in the cryptocurrency market, earning an AAA rating for its robust technology, widespread adoption, and long-term stability.

Why AAA?

Advanced technology (Proof of Work) ensures security and scalability.

Extensive global adoption, with significant developer and institutional involvement.

Highly liquid despite some volatility, positioning it as a leading digital asset.

Bitcoin’s Core Strengths:

Technology

Secure & Decentralized: Bitcoin’s Proof of Work (PoW) consensus mechanism ensures security and resistance to attacks.

Scalability: The system’s design supports a growing number of users while maintaining network integrity.

Adoption

Global Adoption Leader:

Supported by widespread institutional involvement and developer activity.

Bitcoin remains the go-to asset in the crypto ecosystem, often referred to as digital gold.

Risk

Short-term Volatility:

While Bitcoin experiences price fluctuations, its dominance minimizes long-term risks.

High liquidity provides ease for those buying or selling the asset.

Momentum

Strong Price Performance:

Bitcoin has shown consistent long-term growth, with occasional macroeconomic influences.

Recent Developments Impacting Bitcoin

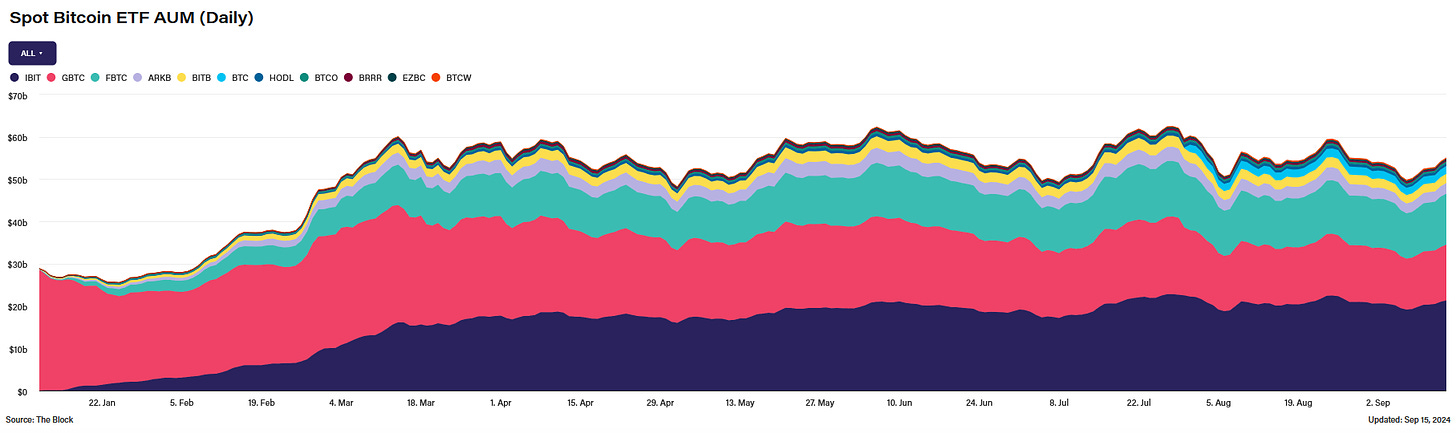

Bitcoin ETFs See Major Inflows:

U.S. spot Bitcoin ETFs recently logged a $263.1M net inflow. Their largest in two months.

Leading inflows came from Fidelity's FBTC ($102.1M) and Ark & 21Shares' ARKB ($99.3M), signaling growing institutional confidence.

MicroStrategy’s Billion-Dollar Bitcoin Purchase:

MicroStrategy added 18,300 BTC to its holdings, spending $1.1 billion at an average price of $60,408 per Bitcoin.

Total holdings now stand at 244,800 BTC, reaffirming corporate interest in Bitcoin as a store of value.

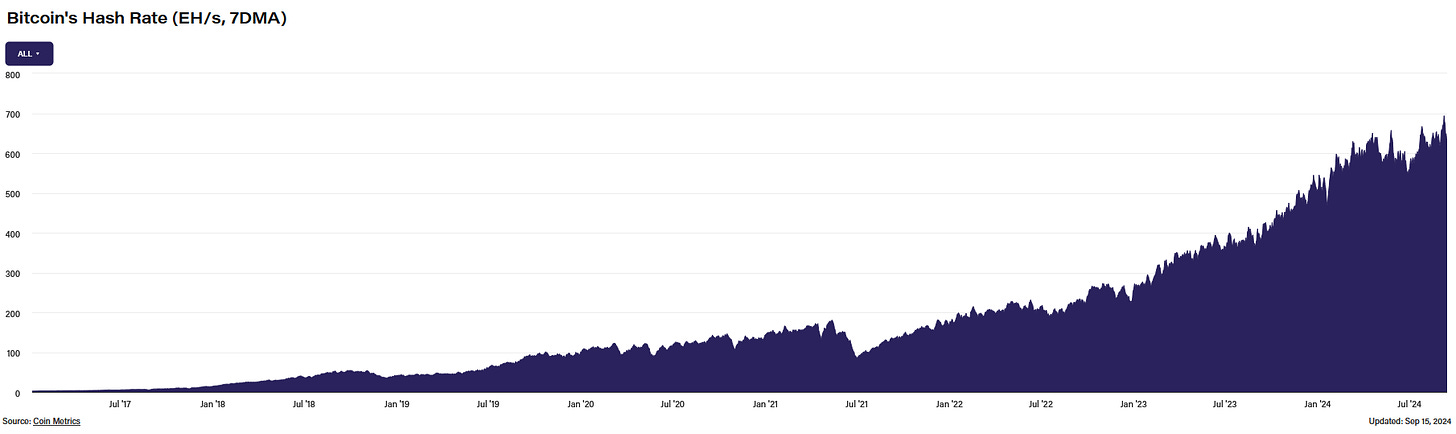

Bitcoin Mining Hits New Highs:

The network’s mining difficulty reached a record high, demonstrating its security and resilience as more miners contribute computational power.

A higher difficulty level indicates a stronger, more decentralized network.

Bitcoin’s Expanding Role in DeFi

Coinbase’s Wrapped Bitcoin (cbBTC):

This new feature allows Bitcoin to be used on Ethereum and Base networks, enabling participation in decentralized finance (DeFi).

Supported by key DeFi protocols such as Aave, Compound, and Curve, cbBTC helps bridge Bitcoin with the broader decentralized ecosystem.

Why This Matters: cbBTC enables Bitcoin holders to access new financial opportunities, such as using Bitcoin as collateral or providing liquidity within DeFi applications.

Outlook for Bitcoin

Current Price: Bitcoin is trading around $60,000 with expectations of a potential all-time high by the end of the year.

Key Influencers:

U.S. Federal Reserve’s interest rate decisions may affect short-term price movements.

Regulatory advancements could further solidify Bitcoin’s position in institutional portfolios.

Master On-Chain Analysis

Gain deeper insights into blockchain networks with my On-Chain Analysis Course.

What You’ll Learn:

Analyze Bitcoin’s network and spot trends.

Interpret data for market sentiment.

Understand crypto valuations with on-chain metrics.

Clear, actionable modules to help you stay ahead in the crypto space.

Final Thoughts:

Bitcoin continues to dominate the digital asset space, supported by increased institutional inflows, major corporate purchases, and its integration into DeFi ecosystems. Its long-term potential remains strong, despite short-term market fluctuations. As regulatory frameworks evolve and innovations like wrapped Bitcoin expand its use case, Bitcoin’s leadership in the crypto market seems secure.

Disclaimer:

The Insight Labs Global Crypto Ratings is a forward-looking research system. Insight Labs or its analysts may hold positions in Bitcoin or other assets mentioned in the ratings. The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.

Crypto products are unregulated and involve substantial risks, including complete loss of principal, pricing volatility, and inadequate liquidity. Insight Labs cannot guarantee the accuracy of the information provided and assumes no responsibility for decisions made based on this information.