Bitcoin: The Antidote to Wealth Erosion and Economic Distortions

Why the Real ‘Redistribution Game’ Isn’t What They’re Telling You and How Bitcoin Could Change Everything

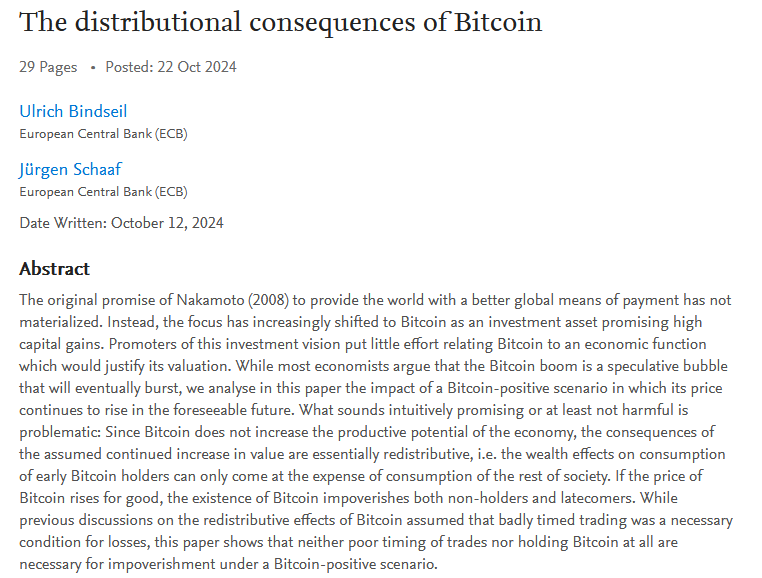

To Ulrich Bindseil, Jurgen Schaaf & European Central Bank

It’s baffling to label Bitcoin’s rise as "impoverishing" without acknowledging the wealth erosion from inflationary policies, a central issue Austrian economists have highlighted for decades.

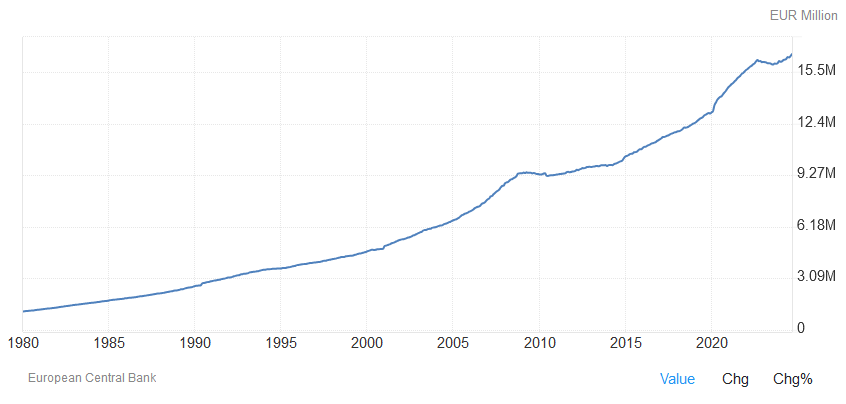

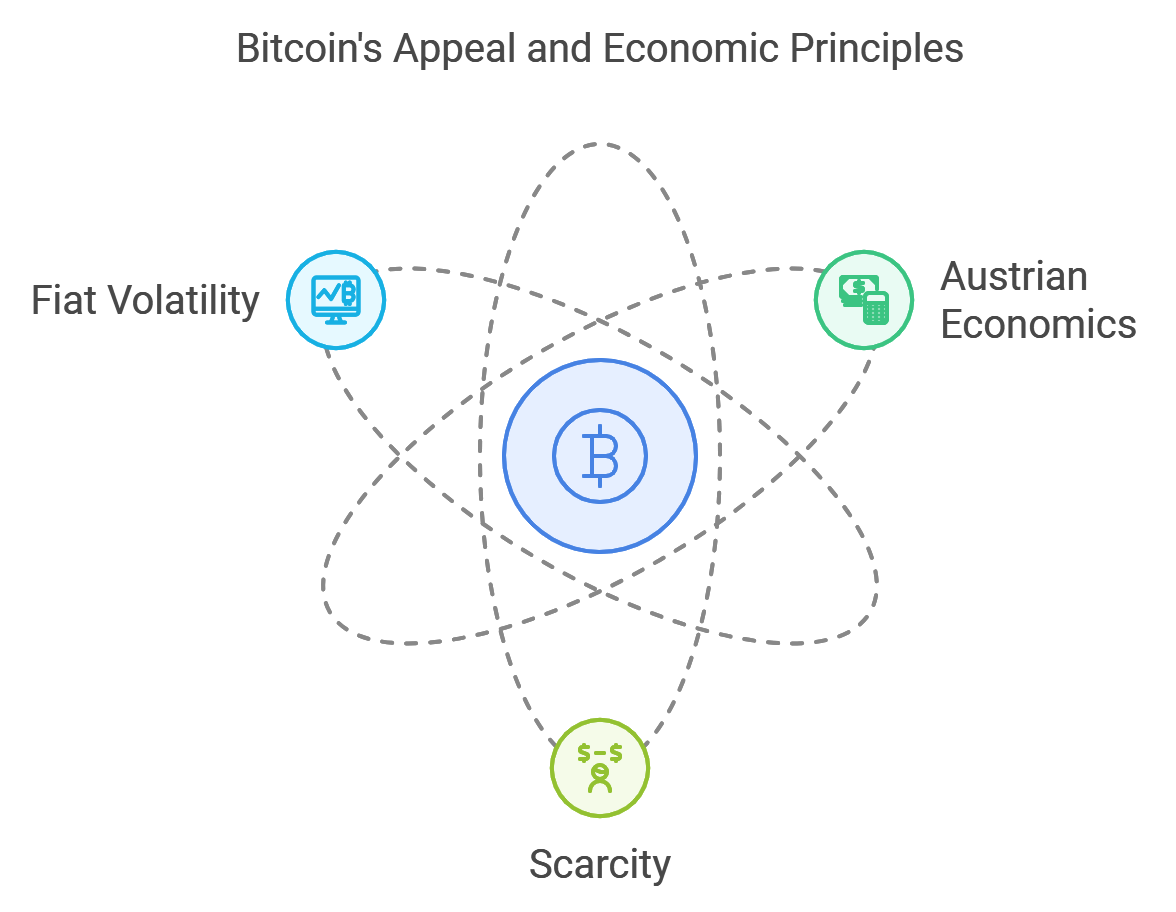

Bitcoin’s value proposition is rooted in sound money principles and scarcity, standing in sharp contrast to fiat currencies with unchecked money supply increases. M3 data shows the Eurozone money supply surged over 23% from 2020 to mid-2022, fueling asset price inflation and widening wealth inequality by funneling capital to those with access to cheap credit.

Bitcoin, with its 21 million supply cap, reflects Mises regression theorem and Rothbard’s views on monetary policy: a currency grounded in scarcity that preserves value across generations. Criticizing Bitcoin as a speculative asset that "doesn’t increase productive potential" disregards its role in high-inflation economies like Argentina and Turkey, where citizens increasingly turn to Bitcoin for stability beyond fiat’s reach. Claiming Bitcoin "impoverishes" latecomers ignores how fiat-driven inflation already does so by eroding purchasing power, a reality Hayek addressed.

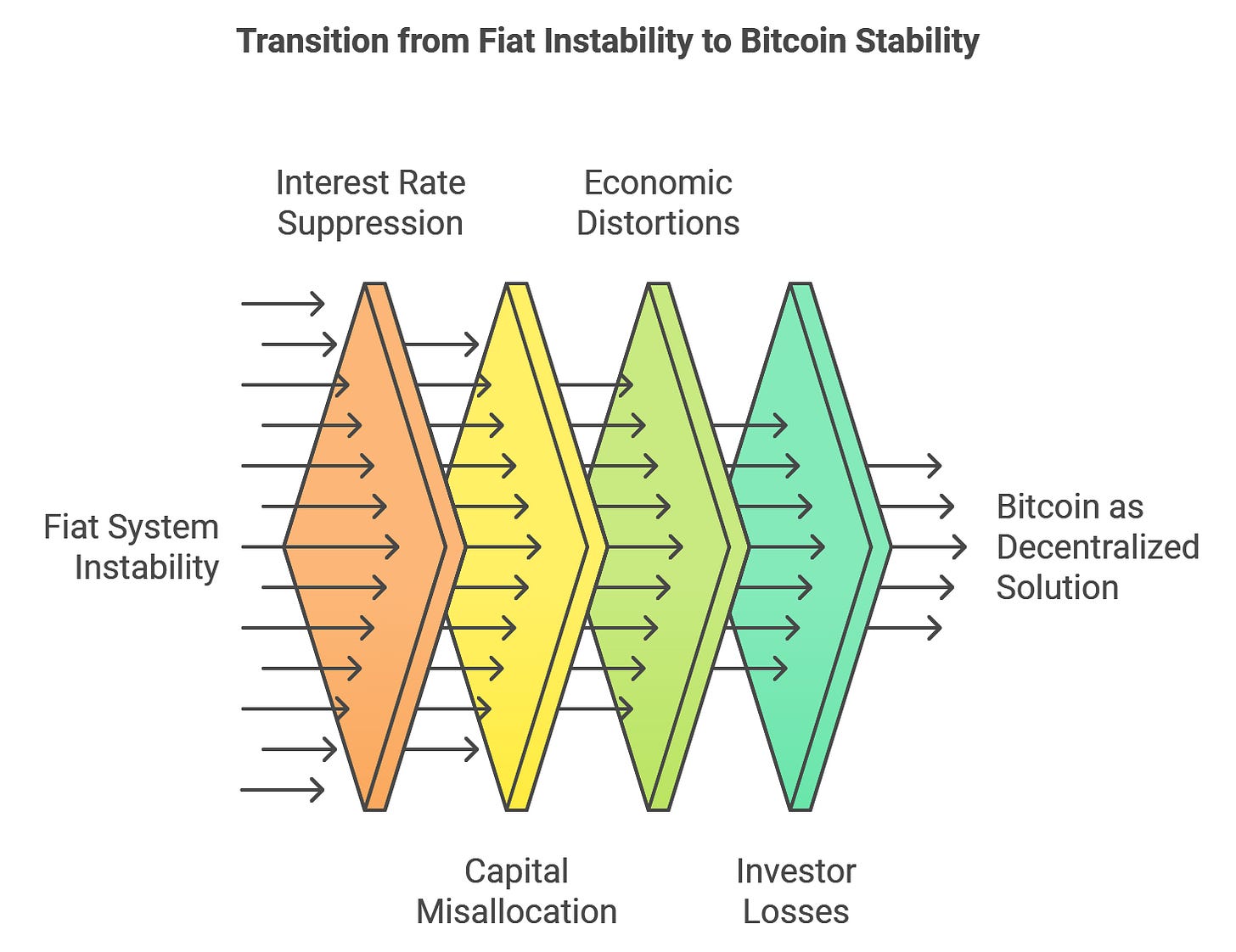

Austrian Business Cycle Theory shows how suppressed interest rates misallocate capital, leading to distortions and crashes that leave retail investors bearing the losses. Bitcoin, by contrast, offers a decentralized alternative outside fiat’s cyclical busts.

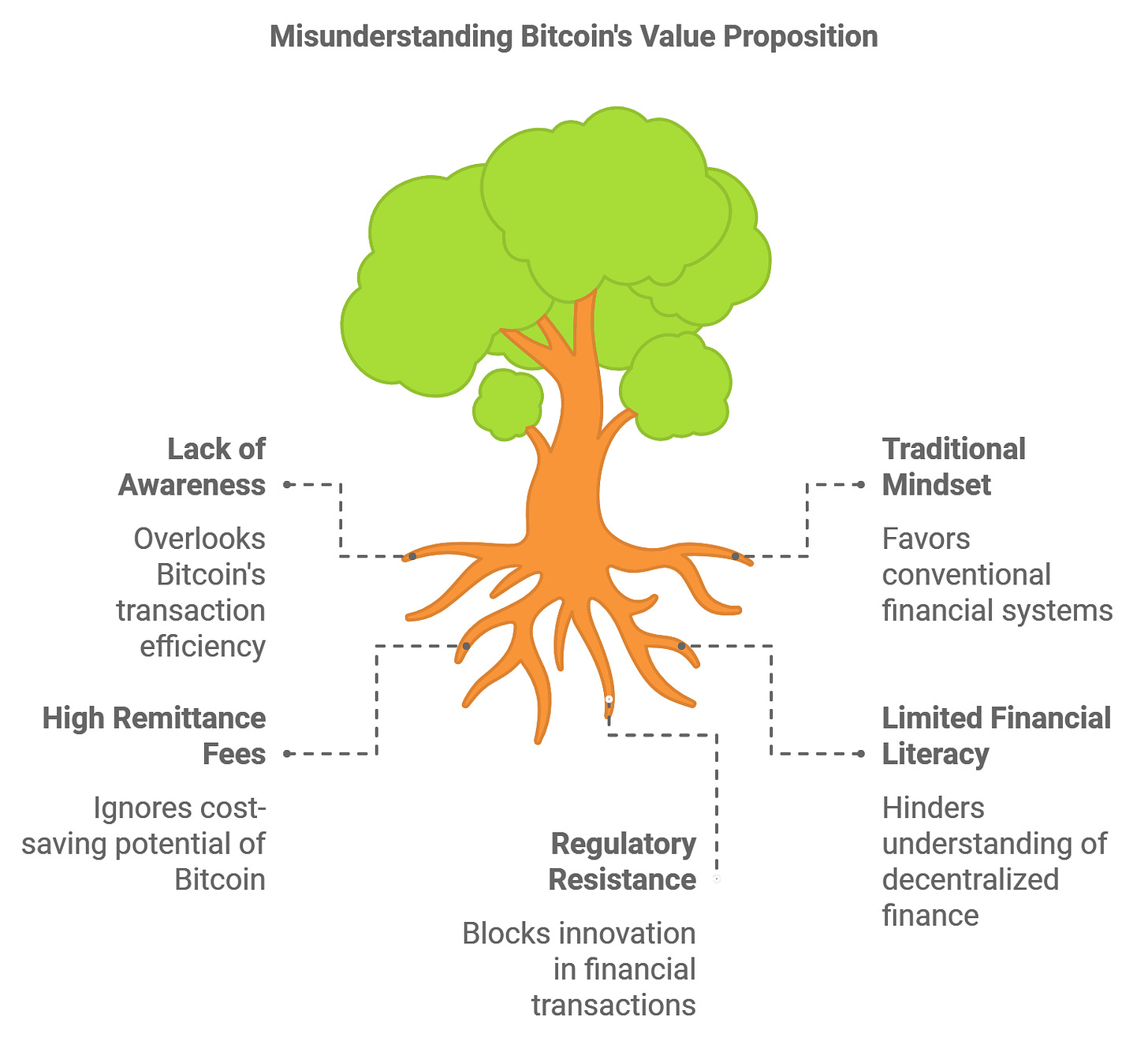

To say Bitcoin doesn’t "add productive value" misses its impact on remittances, cross-border payments, and self-sovereignty. Bitcoin is more than an “asset”, it’s a monetary network that reduces friction in financial transactions, especially in unbanked economies. Traditional remittance services charge 7% fees on average, whereas Bitcoin reduces these costs to fractions of a percent, saving billions in high-remittance countries.

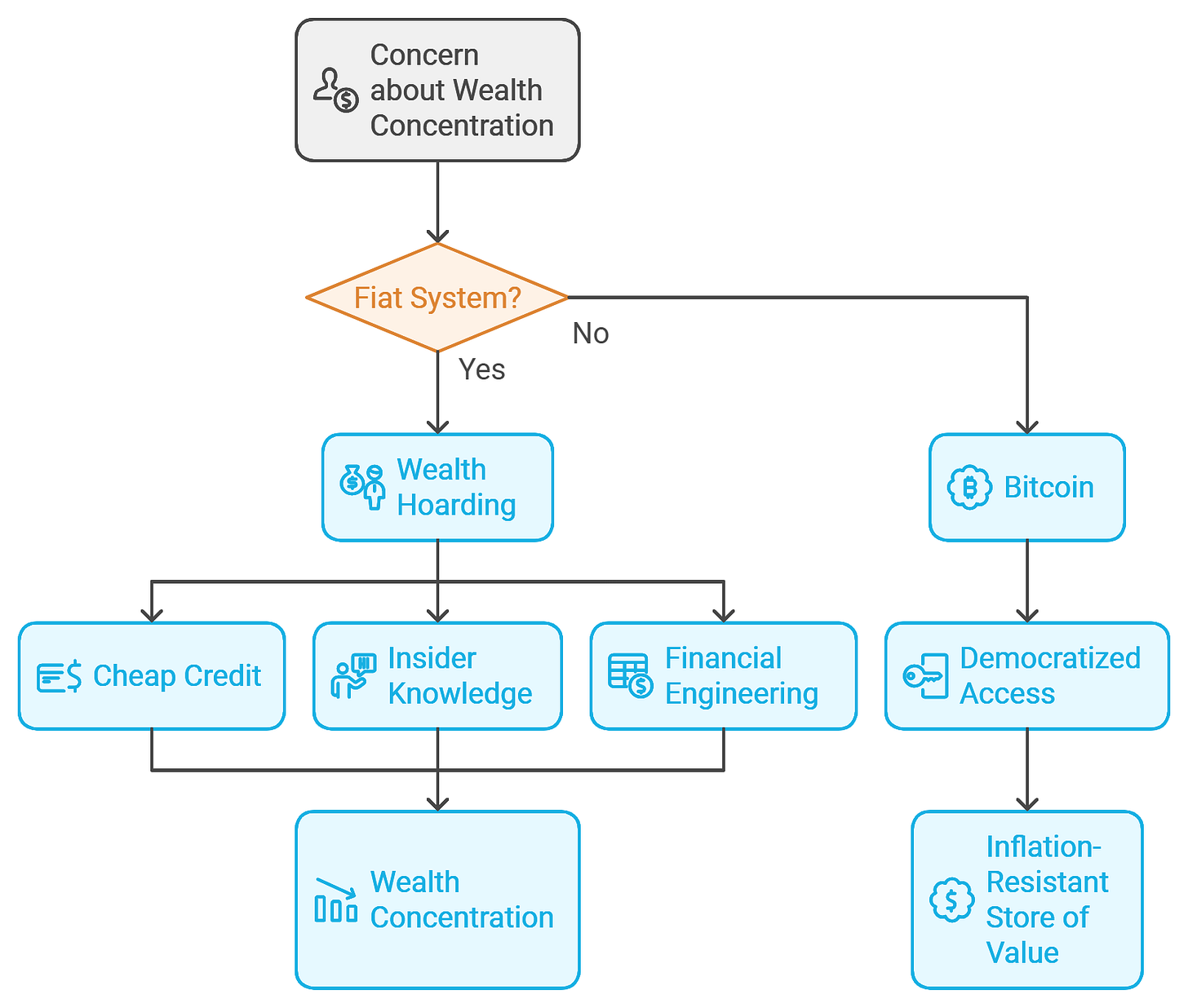

If wealth concentration concerns you, Bitcoin is a solution, not the problem. Fiat systems favor wealth hoarding via cheap credit, insider knowledge, and financial engineering that exclude the average person. Bitcoin democratizes access to an inflation-resistant store of value, without requiring central authority approval.

Austrian economics posits stability from a monetary base free of manipulation, an ideal Bitcoin embodies. Criticizing Bitcoin’s value increase from scarcity only validates its appeal. If it’s a bubble, let it pop on its merits, if not, perhaps it’s time to confront why it resonates as a safe harbor amid fiat volatility.

Disclaimer: Insight Labs or its analysts may hold positions in Bitcoin or other assets mentioned in the post. The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.

Crypto products are unregulated and involve substantial risks, including complete loss of principal, pricing volatility, and inadequate liquidity. Insight Labs cannot guarantee the accuracy of the information provided and assumes no responsibility for decisions made based on this information.