Can Crypto VCs Keep Up? Retail Gains, Tokenized Banking, BlackRock's Big Moves, and Bitcoin's $70K Surge

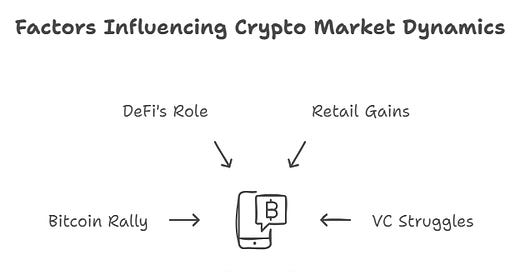

Retail investors thrive as venture capital struggles. BlackRock’s BUIDL token, DBS’s blockchain banking, and Bitcoin’s surge set the stage for crypto’s future.

The liquid crypto market is on fire with Bitcoin surging, retail investors are cashing in, and even Singapore’s largest bank is diving deep into tokenization. But behind the headlines, crypto venture funds are quietly struggling, raising the lowest capital in years. What’s happening under the surface of this split reality?

This week’s blockchain newsletter brings you closer to the heart of these trends. Let’s dive into the most fascinating developments shaping the future of crypto and finance.

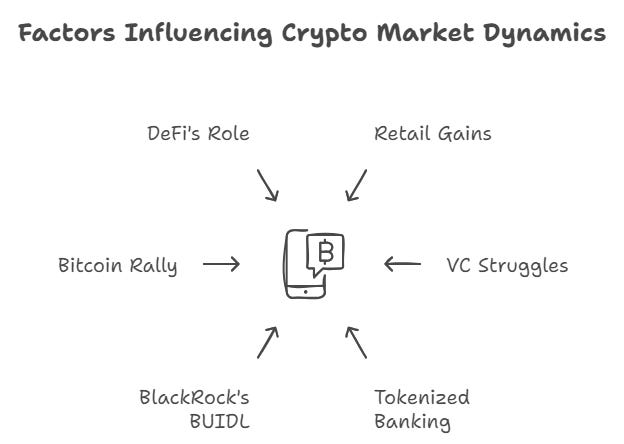

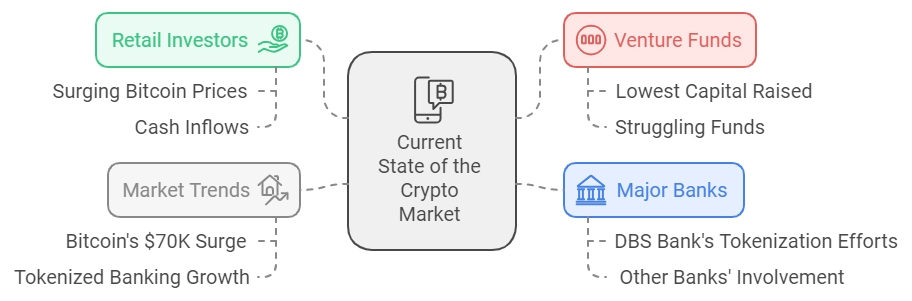

1. Retail Crypto Booms While VCs Struggle for Funds: A Split Reality

How can retail traders be making gains while venture capitalists in crypto face their toughest challenge in years?

The Numbers: Retail investors have enjoyed Bitcoin’s climb and strong ETF flows, but venture capital is facing a drought, with only $140 million raised by crypto VCs last quarter, marking a 3-year low.

Why It Matters: This contrast between thriving public markets and faltering private capital highlights an important dynamic where retail investors are winning, while VCs scramble for funds and future innovations.

💡 Key Insight: The crypto space is evolving in two directions, public markets are booming, but VCs will need a rethink to ride this wave of innovation.

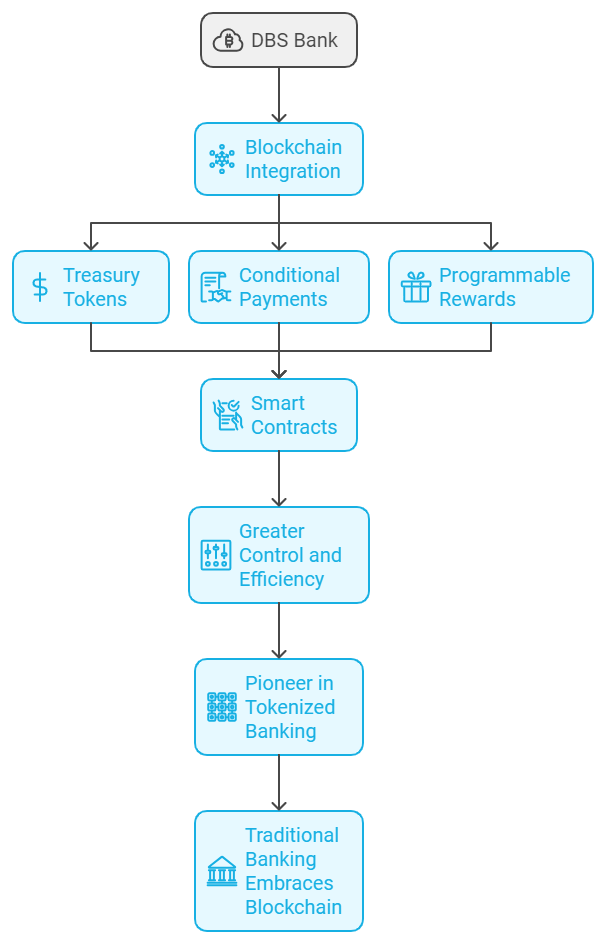

2. Singapore’s DBS Bank Pushes the Frontier of Tokenized Banking

Could your next big bank transaction be settled via blockchain?

DBS Token Services: Singapore’s largest bank, DBS, is bringing blockchain technology into the banking world, offering Treasury Tokens, Conditional Payments, and Programmable Rewards. These services leverage smart contracts for greater control and efficiency.

Why It Matters: With blockchain integration into its core services, DBS is positioning itself as a pioneer in tokenized banking. This leap signals that traditional banking is ready to fully embrace blockchain technology.

💡 Key Insight: DBS’s blockchain-based services highlight how traditional banks are finally taking blockchain mainstream, improving liquidity management and operational workflows for institutional clients.

3. BlackRock’s BUIDL Token: The Future of Crypto Collateral?

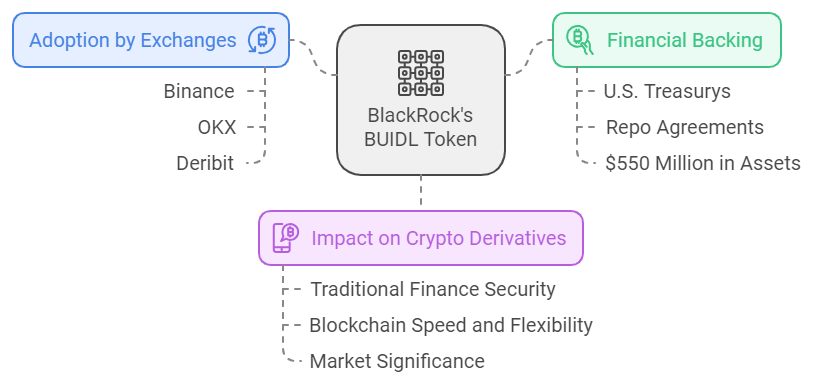

Could BlackRock’s BUIDL token reshape the crypto derivatives market?

The Pitch: BlackRock is actively pushing major crypto exchanges like Binance, OKX, and Deribit to adopt its BUIDL token as collateral for crypto derivatives trades. The BUIDL token is tied to U.S. Treasurys and repo agreements, with $550 million in assets.

Why It Matters: If BlackRock succeeds, BUIDL could become a significant player in crypto derivatives, blending traditional finance security with the speed and flexibility of blockchain-based collateral.

💡 Key Insight: BlackRock’s moves show that major institutions see blockchain not just as an investment, but as a critical part of the future infrastructure for financial markets.

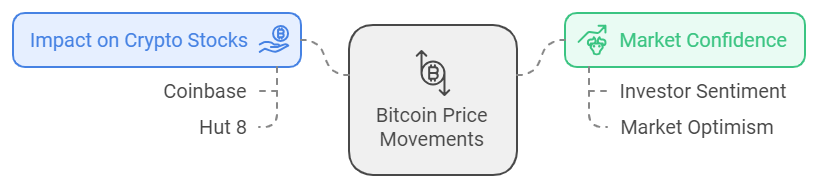

4. Bitcoin Races Towards $70K, Lifting Crypto Stocks

As Bitcoin nears $70,000, who’s benefiting from the rally?

Coinbase & Hut 8 Surge: With Bitcoin’s best weekly performance in over a month, major crypto stocks like Coinbase surged by 8%, and Bitcoin miner Hut 8 saw a nearly 15% rise.

Why It Matters: Bitcoin’s price movements continue to influence crypto-related stocks, signaling broader confidence and optimism about the market’s potential.

💡 Key Insight: The strong rally is not just lifting Bitcoin but fueling a wider market upswing that could pave the way for even bigger institutional investments.

5. Federal Reserve on DeFi: Complementary, Not a Threat

Is DeFi a threat to traditional finance, or can the two coexist?

Fed’s View: Federal Reserve Governor Christopher Waller says DeFi can complement, but not replace, centralized financial systems. He emphasized that while DeFi offers innovative services, traditional intermediaries are still critical.

Why It Matters: This position from the Federal Reserve is a sign that regulators see value in DeFi innovations, but want clear rules to manage the risks.

💡 Key Insight: The future of DeFi will likely involve working alongside traditional finance rather than replacing it, in a hybrid model that could benefit from both systems.

Key Takeaways:

Retail Gains, VC Struggles: Retail investors thrive in public markets while venture capital faces a challenging environment for fundraising.

Tokenized Banking: DBS is leading the charge with blockchain-based banking solutions, showing how banks are embracing the benefits of decentralized technology.

BlackRock’s BUIDL: With BlackRock pitching its BUIDL token to crypto exchanges, expect major shifts in how institutions collateralize crypto derivatives.

Bitcoin’s Rally: Bitcoin’s near-$70K rally is fueling gains in crypto stocks, showing strong market confidence and institutional interest.

DeFi’s Role: The Federal Reserve sees DeFi as complementary to traditional finance, hinting at a future where the two worlds converge.

In Closing:

From DBS Bank’s tokenized services to BlackRock’s bold move into crypto collateral, this week shows the growing integration of blockchain into mainstream finance. As Bitcoin rallies and crypto-related stocks surge, the crypto market continues its march toward broader institutional adoption.

Disclaimer: The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.