Ethereum Eyes $3,000 While Bitcoin Reinforces Dominance: A Quantitative Breakdown

With Ethereum eyeing a key resistance level and Bitcoin holding strong, we dive into the numbers and on-chain data to uncover whether this rally has legs or if the tides are turning in the markets

Bitcoin: A Fortress of Dominance Amid Volatility

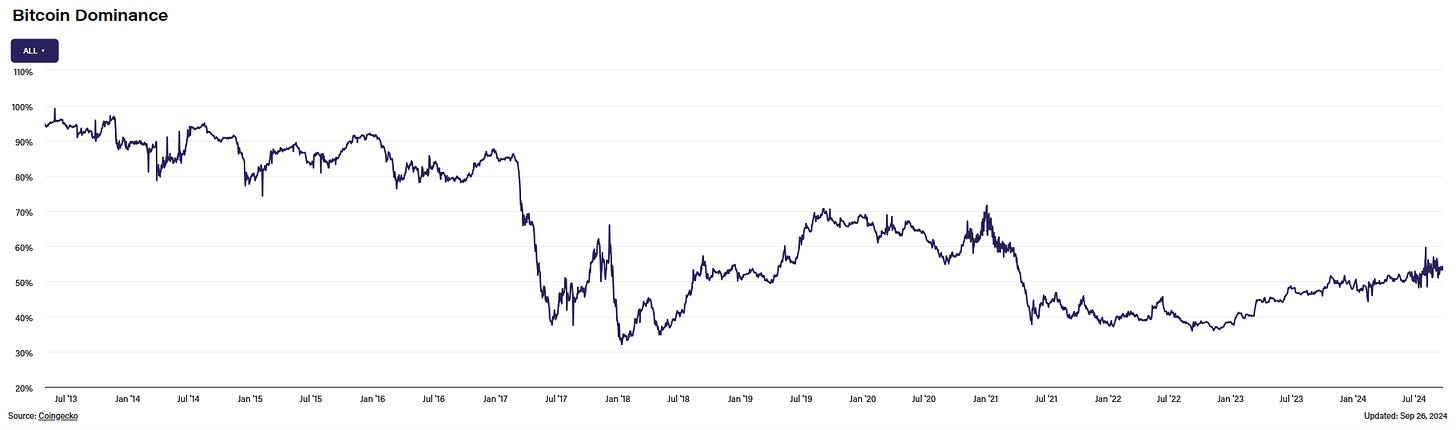

Market Dominance: Bitcoin’s market share touched close to 60%, the highest in 40 months, fueled by the rise of Bitcoin ETFs.

Year-to-Date Performance: Bitcoin has grown by 53.67% YTD, while Ethereum has been comparatively underwhelming at 14.90%.

ETH/BTC Ratio: The ETH/BTC ratio had reached a three-year low of 0.0365, indicating a growing preference for Bitcoin among investors.

Technical Indicators for Bitcoin

Trading Volume: Bitcoin’s daily trading volume remains strong at $35 billion.

Implied Volatility (IV):

Short-Term IV: 1-week IV at 46.21% and 1-month IV at 54.77%, indicating relatively low near-term volatility.

Long-Term IV: 6 month IV at 64.66%, suggesting higher expected volatility over the longer term.

Key Price Levels to Watch

Support Levels: Strong support is evident at $60,000, with additional support at $58,000 if the price experiences a short-term pullback.

Resistance Levels: Key resistance is at $68,000, potentially driven by liquidations and high open interest.

Master On-Chain Analysis

Gain deeper insights into blockchain networks with my On-Chain Analysis Course.

What You’ll Learn:

Analyze Bitcoin’s network and spot trends.

Interpret data for market sentiment.

Understand crypto valuations with on-chain metrics.

Clear, actionable modules to help you stay ahead in the crypto space.

Ethereum's Bullish Momentum: Climbing Toward $3,000

Price Action & Trading Volume Surge

Current Price: Ethereum has experienced a 4.25% increase over the last 24 hours, currently trading near $2,625.

Breakout: ETH broke out from the $2,530 to $2,600 consolidation zone on September 23, 2024, marking a 15% price increase from a week ago.

Trading Volume: A 65% increase in volume suggests heightened market participation from both retail and institutional traders, supporting the current price momentum.

On-Chain Data Insights

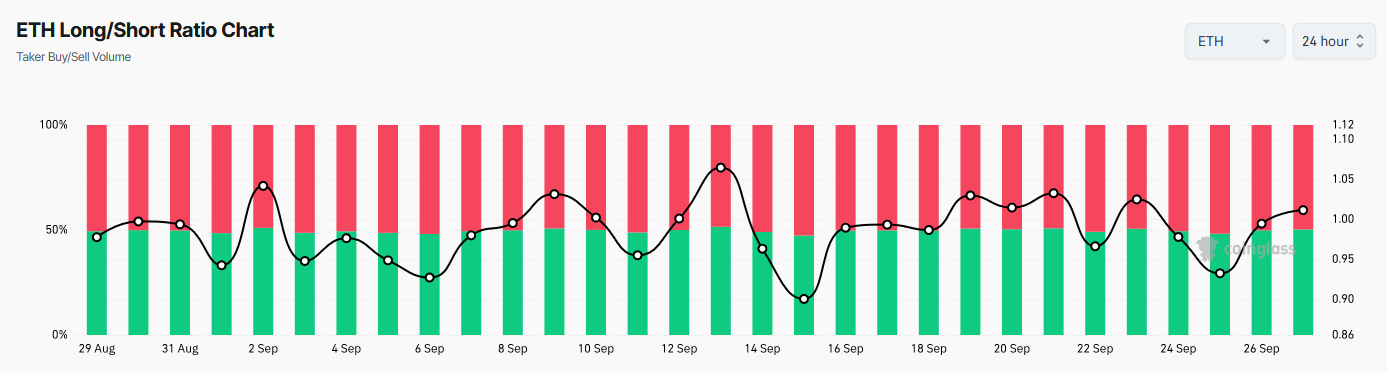

ETH Long/Short Ratio: Currently, the ETH long/short ratio stands at 1.01, indicating that 50.28% of traders hold long positions, reflecting an overall positive market sentiment. The relatively balanced ratio, however, suggests that some traders are approaching the market cautiously.

Futures Open Interest: Open interest for ETH has risen by 4.8% in the past 24 hours, reaching over $12 billion across major exchanges. This increase in open interest signifies that traders are actively establishing positions, with a focus on potential upward price movement.

Key Price Levels to Watch

Support Levels: Current support levels include $2,600, with stronger support at $2,530, the lower boundary of the recent consolidation zone.

Resistance Levels: The next major resistance is $2,900, with $3,000 representing a psychological threshold. Breaking above $3,000 could lead to further gains toward $3,200.

Conclusion

Ethereum: Ethereum's rally toward $3,000 is supported by strong technical data, increased trading volumes, and positive on-chain metrics. However, resistance at $3,000 remains a crucial level, and caution is warranted, particularly around potential profit-taking.

Bitcoin: Bitcoin continues to demonstrate dominance in the crypto market, with key metrics like dominance, open interest, and institutional participation reinforcing its role as a stable, long-term asset. BTC appears well-positioned for potential moves upto $68,000, though market conditions should be closely monitored.

Disclaimer:

Insight Labs or its analysts may hold positions in Bitcoin or Ethereum. The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.

Crypto products are unregulated and involve substantial risks, including complete loss of principal, pricing volatility, and inadequate liquidity. Insight Labs cannot guarantee the accuracy of the information provided and assumes no responsibility for decisions made based on this information.