Ethereum Rating Overview: Institutional-Grade Insights for the Future of Blockchain

Breaking down Ethereum's strengths, challenges, and its pivotal role in decentralized finance and smart contracts with a data-driven approach.

Asset Name: Ethereum (ETH)

Overall Rating: AA

Tech/Adoption Grade: AA+

Market Performance Grade: A

Key Takeaways:

Ethereum stands as the leading platform for decentralized applications (dApps) and smart contracts, earning it an AA rating for its robust technology and widespread adoption, despite challenges in scalability and market volatility.

Why AA?

Innovative Technology: Ethereum's transition to Proof of Stake (PoS) and its continued development of Layer 2 solutions make it a top contender in the blockchain space.

Global Adoption: Ethereum remains the primary blockchain for DeFi and NFTs, driving network usage and institutional interest.

Market Volatility: Ethereum experiences more price fluctuations compared to Bitcoin, contributing to its lower market performance rating of A.

Ethereum’s Core Strengths:

Technology

Transition to PoS: Ethereum’s shift to Proof of Stake reduces energy consumption and enhances scalability, though it’s still implementing full scalability improvements like Layer 2 rollups.

Smart Contract Leader: Ethereum’s Ethereum Virtual Machine (EVM) powers thousands of decentralized applications (dApps) and serves as the foundation for DeFi, earning it an AA+ Tech/Adoption Grade.

Adoption

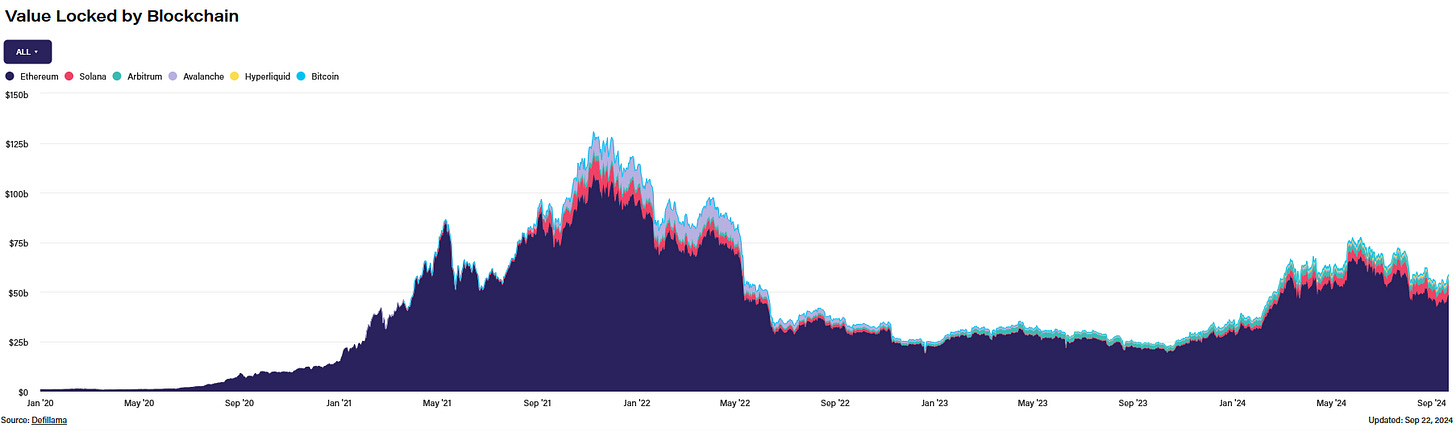

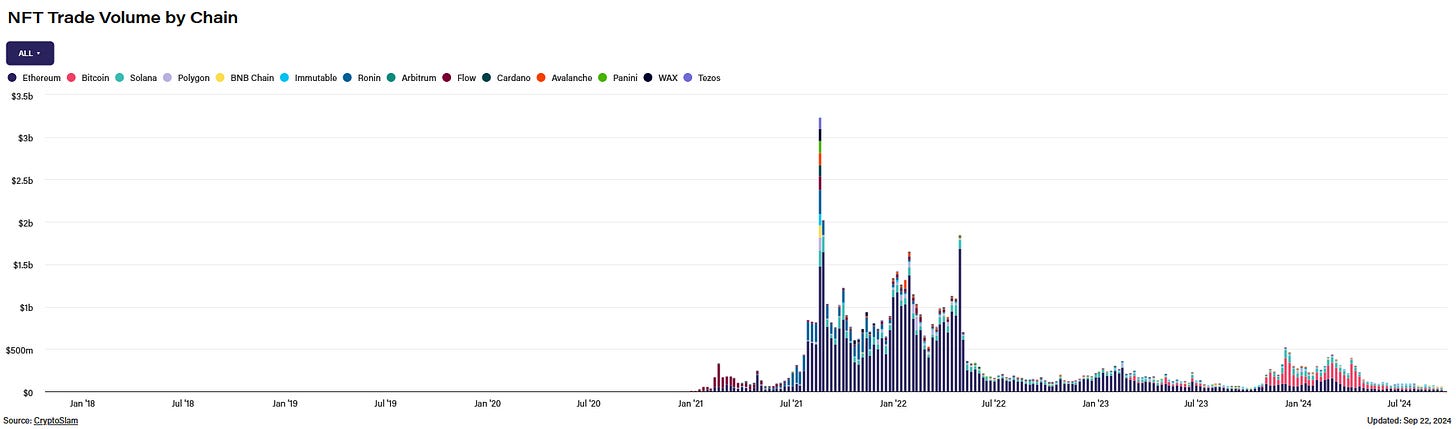

Global Adoption Powerhouse: Ethereum powers over 60% of the top 100 DeFi protocols and is the backbone of the NFT market. While network congestion during peak periods can limit accessibility, Ethereum remains unmatched in developer activity and global dApp usage.

Risk

Higher Volatility: Ethereum faces more significant price swings compared to Bitcoin, attributed to its broader utility beyond just a store of value. Its A rating in market performance reflects this higher risk profile.

Liquidity: Although highly liquid, Ethereum is outpaced by Bitcoin in market stability. The rise of competing Layer 1 blockchains like Solana has added pressure.

Momentum

Price Performance: Ethereum’s price performance has been strong over time but more susceptible to market sentiment and competition. Layer 2 solutions continue to be rolled out, contributing to its A market performance grade.

This detailed Ethereum rating is available across all subscription tiers for a limited time. For deeper analysis on other top digital assets, consider upgrading to Pro Edge for exclusive content.

Recent Developments Impacting Ethereum

Ethereum ETPs: The approval of Ethereum ETPs opens the door for further institutional investment, reaffirming Ethereum’s status as a non-security.

SEC’s Non-Security Designation: Ethereum’s approval as an ETP (rather than ETF) signals confidence in its decentralized structure and long-term viability.

Ethereum in DeFi and NFTs

DeFi Dominance: Ethereum continues to dominate the DeFi space with platforms like Uniswap, Aave, and Sky Money (Formerly MakerDAO) built on its blockchain.

NFTs: The platform is the go-to for most NFTs, despite facing scalability challenges and high gas fees during periods of congestion.

Outlook for Ethereum

Current Price: Ethereum is trading around $2,583, and at Insight Labs, we expect a strong recovery as market conditions shift. With ongoing improvements in Layer 2 scaling solutions, rising institutional interest, and Ethereum's dominance in DeFi and NFTs, we predict Ethereum could push toward $3,000 in the near term, positioning itself for further growth by year-end.

Institutional Interest: Expect continued growth in institutional investment, especially as Ethereum’s Layer 2 solutions further scale the network.

Master On-Chain Analysis

Gain deeper insights into Ethereum’s network with my On-Chain Analysis Course.

What You’ll Learn:

Analyze Ethereum’s network and identify key metrics that drive price and adoption.

Learn how on-chain data can provide insights into market sentiment and liquidity.

Break down complex concepts into actionable data-driven strategies.

Final Thoughts:

Ethereum's strong technology, DeFi leadership, and growing institutional adoption keep it well-positioned for long-term success, despite occasional volatility. The recent introduction of Ethereum ETPs further strengthens its future in institutional markets.

Disclaimer:

The Insight Labs Global Crypto Ratings is a forward-looking research system. Insight Labs or its analysts may hold positions in Bitcoin or other assets mentioned in the ratings. The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.

Crypto products are unregulated and involve substantial risks, including complete loss of principal, pricing volatility, and inadequate liquidity. Insight Labs cannot guarantee the accuracy of the information provided and assumes no responsibility for decisions made based on this information.