Franklin Templeton on Aptos, Bitcoin's Market Moves, Swift's Digital Asset Trials, and the Latest in Crypto

Exploring the latest in blockchain: Franklin Templeton’s integration with Aptos, Bitcoin’s market dynamics amid geopolitical risks, and Swift’s push for digital asset transactions in 2025.

As the blockchain world continues to evolve, this week we see a mix of market fluctuations, innovative trials in digital assets, and key moves by financial giants. Here’s a breakdown of the most important stories that will impact the crypto landscape.

1. Franklin Templeton Launches OnChain U.S. Government Money Fund on Aptos

In a strategic move to expand its blockchain reach, Franklin Templeton has launched its OnChain U.S. Government Money Fund (FOBXX) on the Aptos blockchain, marking its fifth network integration. This collaboration with the Aptos Foundation showcases the asset manager’s commitment to bridging traditional finance and decentralized systems.

Key Details: The FOBXX fund is represented by the BENJI token and has already received over $20 million in subscriptions on Aptos, adding to its presence on other networks like Stellar, Polygon, Avalanche and Arbitrum.

What’s New: This launch highlights increased interoperability between real-world assets and blockchain networks, especially non-EVM chains like Aptos, which is known for its scalability and speed.

💡 Why it matters: Franklin Templeton’s foray into the Aptos ecosystem demonstrates the growing role of tokenized government securities and the integration of traditional finance with blockchain, setting the stage for future cross-network innovations.

2. Bitcoin’s Price Dip Amidst Geopolitical Risks and U.S. Election Factors

As geopolitical risks rise, Bitcoin may temporarily dip below the $60,000 mark, potentially setting up a prime buying opportunity. The current market suggests that such a decline could offer a strategic entry point for investors looking to accumulate Bitcoin before the next surge.

Key Insight: Trump’s rising chances in the U.S. presidential race add an interesting layer to Bitcoin’s outlook. While geopolitical risks may push Bitcoin’s price lower in the short term, Trump’s pro-crypto stance could improve Bitcoin's long-term prospects.

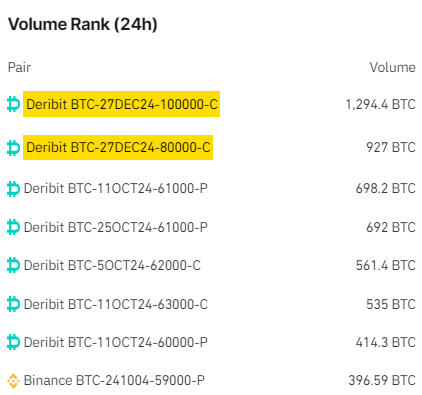

What to Watch: Bitcoin call options for a strike price of $80,000 expiring in December have seen an uptick, suggesting market optimism for a rebound after the dip.

💡 Why it matters: Geopolitical instability and political shifts are playing a significant role in shaping Bitcoin’s market trajectory, providing both risks and opportunities for investors.

3. Swift to Begin Live Trials for Digital Asset Transactions in 2025

Swift, the global financial messaging giant, announced that live trials for digital asset transactions will begin in 2025. This marks Swift’s first move beyond experimental blockchain transactions, as they gear up for real-world applications.

What’s New: The trials will include banks from North America, Europe, and Asia, leveraging Swift’s network to facilitate cross-border transactions between digital and traditional currencies.

The Bigger Picture: These trials aim to showcase how financial institutions can use existing Swift infrastructure to handle both emerging digital assets and established currencies seamlessly.

💡 Why it matters: Swift’s trials represent a significant step toward integrating digital currencies into traditional banking systems, potentially making blockchain-based transactions mainstream.

4. FTX Estate to Sell Locked Worldcoin Tokens at a Discount

As part of its ongoing effort to recover funds for creditors, the FTX estate plans to sell $38 million worth of locked Worldcoin tokens at a steep discount. Bids for the tokens, which will unlock gradually until 2028, are expected to be submitted this week.

Key Details: Discounts of 40% to 75% are expected for these tokens, with notifications for accepted bids coming by Thursday.

Why Now?: This sale follows earlier auctions of Solana holdings by the FTX estate, as they continue to liquidate crypto assets to repay creditors.

💡 Why it matters: The sale of locked tokens at such significant discounts reflects the growing demand for illiquid assets in the crypto space, even amid market volatility.

Master On-Chain Analysis

Gain deeper insights into blockchain networks with my On-Chain Analysis Course.

What You’ll Learn:

Analyze Bitcoin’s network and spot trends.

Interpret data for market sentiment.

Understand crypto valuations with on-chain metrics.

Clear, actionable modules to help you stay ahead in the crypto space.

5. Bitwise Files for Spot XRP ETF Amid Ongoing SEC Battles

Crypto asset manager Bitwise has filed for a spot XRP ETF, marking another potential milestone in the ongoing regulatory battle with the SEC. This ETF would provide exposure to XRP, the digital token at the center of a legal fight between the SEC and Ripple.

What's New: Bitwise asserts that XRP is not a security, pushing back against the SEC’s stance. This filing follows recent approvals of spot Bitcoin and Ethereum ETFs, signaling continued momentum for crypto-focused financial products.

What’s at Stake: If approved, this ETF could face liquidation if XRP is deemed a security, adding another layer of complexity to the filing.

💡 Why it matters: With ETF filings gaining traction, this is another critical step toward mainstream adoption of crypto assets. However, regulatory hurdles remain a major factor in the U.S. market.

Key Takeaways:

Franklin Templeton & Aptos: The integration of the FOBXX fund with Aptos highlights the growing significance of non-EVM blockchains and tokenized government securities.

Bitcoin’s Market Dynamics: Geopolitical risks could push Bitcoin below $60,000, but analysts see this as a buying opportunity, especially with Trump’s rising election odds.

Swift’s Digital Asset Trials: Swift’s live bank trials in 2025 could bridge the gap between traditional finance and digital assets, offering a glimpse into the future of cross-border payments.

FTX Estate’s Token Sale: The sale of locked Worldcoin tokens at deep discounts showcases the demand for illiquid crypto assets despite market challenges.

Bitwise’s XRP ETF: If approved, the XRP ETF could provide a new avenue for investors, though regulatory concerns loom large.

In Closing: This week’s developments show that while crypto markets remain volatile, there’s no shortage of innovation and regulatory shifts on the horizon. From Swift’s digital trials to geopolitical influences on Bitcoin, these stories highlight the fast-evolving nature of the blockchain space.

Stay ahead of the curve with Insight Labs, and keep your finger on the pulse of whats important in blockchain & crypto.

Disclaimer:

The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.

Crypto products are unregulated and involve substantial risks, including complete loss of principal, pricing volatility, and inadequate liquidity. Insight Labs cannot guarantee the accuracy of the information provided and assumes no responsibility for decisions made based on this information.