Stablecoins: Powering the Future of Finance

How Stablecoins are Reshaping Global Finance, From Emerging Markets to Institutional Adoption

Stablecoins have solidified their place as critical pillars in the crypto ecosystem, evolving from speculative trading tools to essential instruments in real-world financial transactions. This edition brings together the latest data from Ethereum’s on-chain volumes, Singapore’s merchant payments, and emerging market usage, giving you a comprehensive overview of how stablecoins are reshaping global finance.

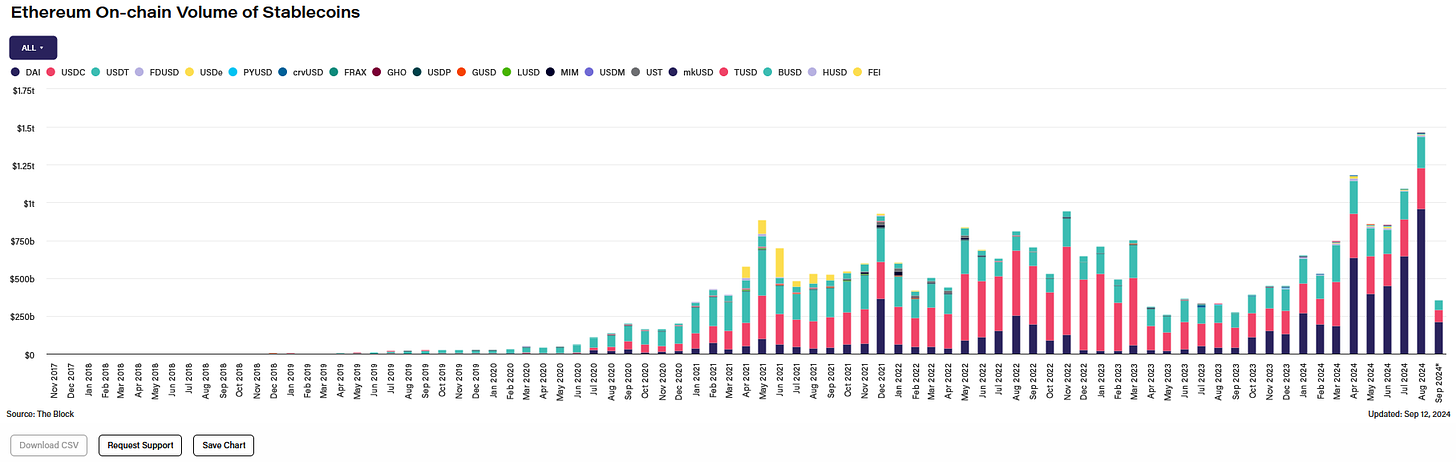

Ethereum's Record Stablecoin Volume: $1.46 Trillion and Rising

Ethereum has hit a new milestone in stablecoin usage, with an on-chain volume of $1.46 trillion, more than double from $650 billion at the start of 2024.

DAI, the decentralized stablecoin, has seen extraordinary growth, leading with $960 billion in volume. This sharp rise signals increasing trust in decentralized finance (DeFi) solutions.

Key observation: While DAI tops the chart, USDT and USDC remain more reliable for transactional stability, as DAI's volume could be inflated by wash trading and internal transfers.

USDC and USDT maintain a stronghold on DeFi operations, providing the core liquidity that powers decentralized applications (dApps), lending protocols, and yield farming. This stability helps ensure liquid markets with minimal slippage.

PYUSD (PayPal's stablecoin) is emerging as a contender, with its volume jumping from $500 million to $2.4 billion in a short period. This highlights how traditional financial players are integrating crypto into their ecosystems to lower costs and improve cross-border transactions.

Analysis:

Ethereum’s dominance in stablecoin volume showcases its role as the bedrock of DeFi and crypto financial systems. Higher volumes typically indicate deeper liquidity pools, reducing friction in trades and fostering a more efficient market.

The rise of PYUSD exemplifies the ongoing convergence between traditional finance (TradFi) and decentralized finance (DeFi), proving that stablecoins aren’t just for crypto enthusiasts but are becoming mainstream financial tools.

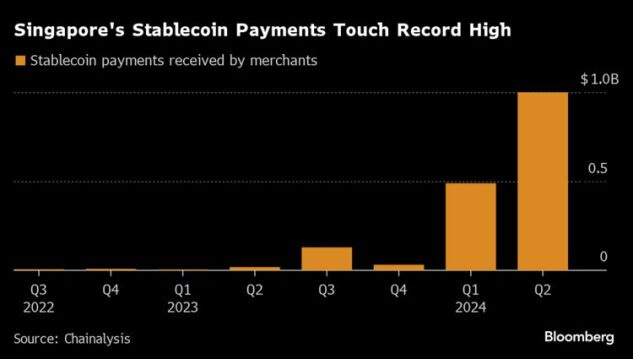

Singapore’s Stablecoin Payment Boom: $1 Billion and Counting

Singapore has seen an unprecedented rise in merchant stablecoin payments, reaching $1 billion in Q2 2024, up from just $161 million in 2023.

Why the growth?

Merchants are adopting stablecoins for their low fees, speed, and efficiency compared to traditional payment rails.

Singapore’s regulatory clarity has made it a global hub for digital asset innovation, encouraging businesses to integrate stablecoins into their operations.

Stablecoins may still represent a small portion of overall payments in Singapore (compared to $56.2 billion in retail card payments), but the trend is accelerating rapidly, driven by cross-border e-commerce and global trade.

Analysis:

Key takeaway: Singapore’s stablecoin adoption is a bellwether for how the world might adopt these assets for daily commerce. As merchants realize the benefits of lower costs and faster settlement times, the use of stablecoins for business payments will likely continue to climb. This is a key inflection point for stablecoins moving beyond speculative use cases.

Stablecoins in Emerging Markets: Beyond Speculation

A recent survey across Brazil, Nigeria, Turkey, Indonesia, and India has shed light on stablecoins' real-world applications, far beyond just crypto speculation.

Key findings from Castle Island Ventures, Brevan Howard, and Visa Crypto’s survey:

Stablecoin usage in emerging markets isn’t limited to trading but spans across:

Currency conversion

Remittances

Paying for goods

Salary payments

The survey estimates that $3.7 trillion in value was settled with stablecoins in 2023, with $2.6 trillion already settled in 2024. These figures indicate that real-world use cases of stablecoins are growing rapidly, despite market volatility.

Regional highlights:

Nigeria: Stablecoins are crucial for saving money in USD, especially with local currency volatility. Citizens and businesses use stablecoins to bypass capital controls and maintain their savings in a stable asset.

Turkey: In contrast, the most common use case is yield generation through stablecoins, as citizens seek ways to hedge against inflation by leveraging DeFi protocols.

Indonesia: Crypto platform Pintu reported that stablecoins are now more accessible than USD banking, with yield generation up to 6% drawing attention.

B2B payments and arbitrage are common, with stablecoins providing easier access to USD markets than traditional banking systems.

Analysis:

Emerging markets are showing the true utility of stablecoins as tools for financial inclusion. Whether it's for preserving wealth in unstable economies or remittances across borders, stablecoins are unlocking financial services for those who lack access to traditional banking infrastructure.

Key takeaway: As stablecoin usage grows, especially in regions with currency instability or restrictive banking environments, expect to see continued growth in DeFi and global stablecoin adoption.

Stablecoin Adoption’s Bigger Picture:

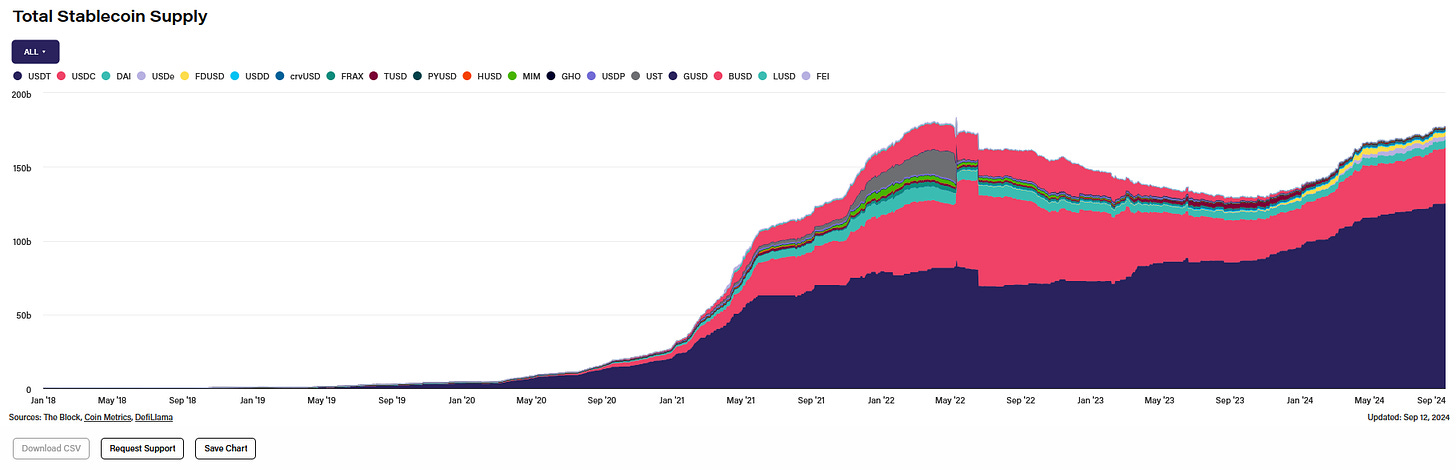

Global Supply: The total supply of stablecoins peaked at $192 billion in 2022 and continues to rise after recovering in late 2023.

Top Blockchains: Ethereum remains the most valuable blockchain for stablecoin settlements, followed by Tron, Arbitrum, and Binance Smart Chain.

Emerging Trends: The stablecoin market remains competitive, with established players like USDC and USDT dominating the market. However, new entrants like Mountain Protocol's USDM represent a new wave of innovation, where stablecoins are designed not just to hold value but to generate income for users. This could reshape the landscape, especially for institutional players and high-net-worth individuals looking to park funds in stablecoins while earning passive returns.

Analysis:

As the competition heats up, stablecoin providers will need to differentiate themselves through better governance models, higher transparency, and additional yield opportunities. This bodes well for consumers and businesses, who will benefit from more options and better product offerings.

Final Thoughts: The Future of Stablecoins

Stablecoins have become the lifeblood of DeFi, enabling everything from liquidity provision to cross-border payments. As the market matures, stablecoins will play an increasingly important role in both emerging markets and global finance.

With $170 billion in stablecoins currently circulating, the growth we’re witnessing in on-chain volumes, merchant payments, and new use cases signals a healthier, more robust DeFi ecosystem.

Stablecoins are no longer just speculative tools. They are becoming mainstream, with applications in real-world commerce, remittances, and financial inclusion.

Looking ahead: The continued integration of traditional finance players, like PayPal and others, into the stablecoin market will bridge the gap between DeFi and TradFi, accelerating the mainstream adoption of decentralized financial systems.

Stay tuned for next week’s on-chain intelligence, where we’ll dive deeper into the latest in DeFi and crypto adoption.

Disclaimer:

The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.